Your Partner in Australian Art.

Investment, Curation & Leasing

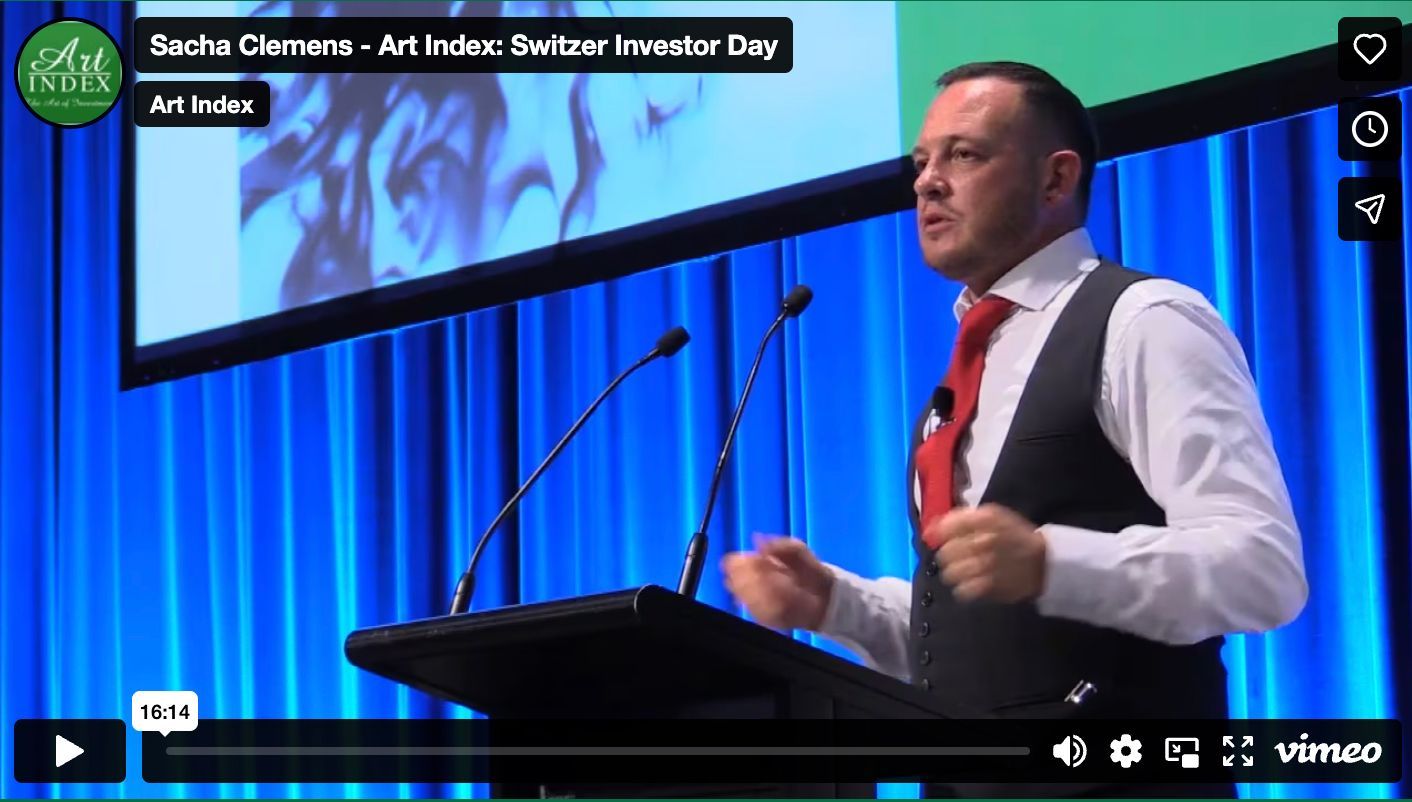

At Art Index, we connect discerning investors, seasoned collectors, and passionate art lovers with the finest Australian and First Nations art. Discover how a thoughtfully acquired art collection can serve as a compelling tangible asset, enriching your life and strategically diversifying your portfolio.

Our clients look to protect their portfolios with low-risk investments. If you're looking into alternate assets as a form of diversification or as a way to protect your portfolio, you're in the right place!

Who We Are, & Who We Are Not

This is the text area for this paragraph. Once you've added your content, you can fully customize its design using the tools available — adjust colors, fonts, font sizes, alignment, and more. To style specific words or phrases, simply highlight the text and choose from the formatting options in the text editing bar.

WHY INVEST IN FINE ART?

Capital Growth

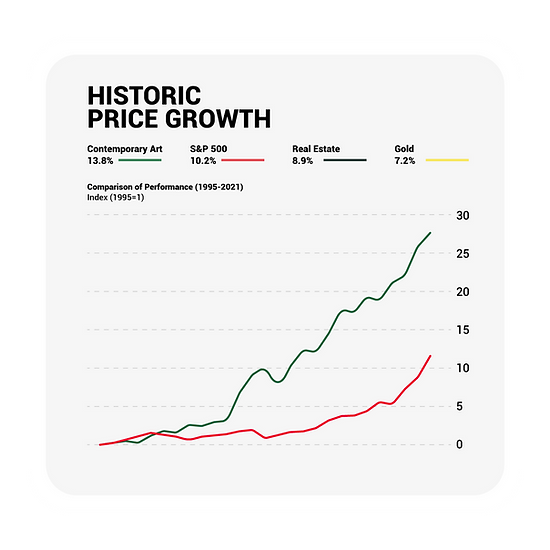

Contemporary art has shown historical price growth of 13.8% per annum compared to the S&P500 at 10.2%

Income

With buy-to-lease options, rental income of 7-10.25% p.a. can be generated within 30 days of investing with Art Index.

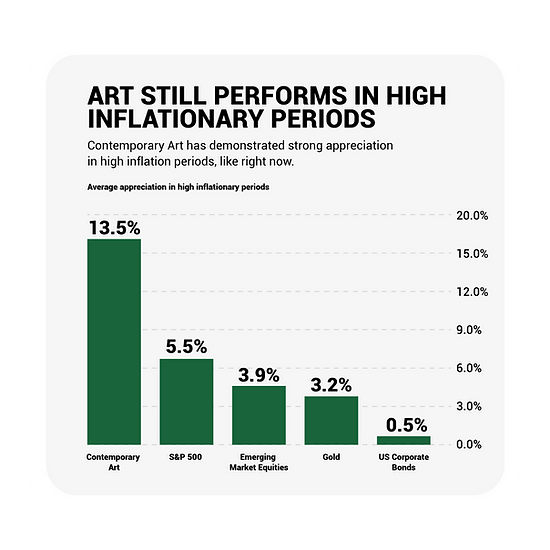

Hedge against inflation

In periods of high inflation, art has demonstrated 13.5% price appreciation compared to the S&P500 at 5.5% and gold at 3.2%

Contemporary Art's Historic Price Surge vs. Traditional Investments

For decades, investment portfolios have been built on a foundation of traditional assets like stocks and bonds. However, contemporary art has emerged as a compelling alternative asset class with a proven track record.

Recent market analysis highlights this shift, showing that contemporary art has demonstrated an average historical price growth of 13.8% per annum, outperforming the S&P 500 at 10.2% over comparable periods.

The value of art is influenced by unique factors like an artist's legacy and critical reception, giving it a low correlation to traditional markets and making it a powerful tool for portfolio diversification.

This resilience is particularly pronounced in times of economic uncertainty. Data shows that art has demonstrated 13.5% price appreciation during inflationary periods, positioning it as a tangible store of value that can protect and grow wealth. At Art Index, we believe that understanding these evolving values is key to building a truly modern and resilient investment portfolio—one that offers not just financial returns, but also a connection to culture and a legacy that endures.

High Inflation and the Steady Performance of Art Investments

In periods of high inflation, the purchasing power of money erodes, and traditional investments can struggle to keep pace.

However, fine art has a distinct advantage as a tangible asset. Its value is not directly tied to a currency's performance, but rather to its scarcity, artistic merit, and a robust collector demand that often remains strong even during economic downturns. This unique market dynamic allows art to act as a powerful hedge against inflation.

Data from inflationary periods demonstrates this resilience. While the S&P 500 saw an average appreciation of 5.5% and gold was at 3.2%, fine art investments showed a strong 13.5% price appreciation.

This performance highlights art’s role as a reliable store of value. Investing in quality art with an expert advisor like Art Index is a strategic way to build a resilient portfolio and protect your wealth from the effects of inflation.

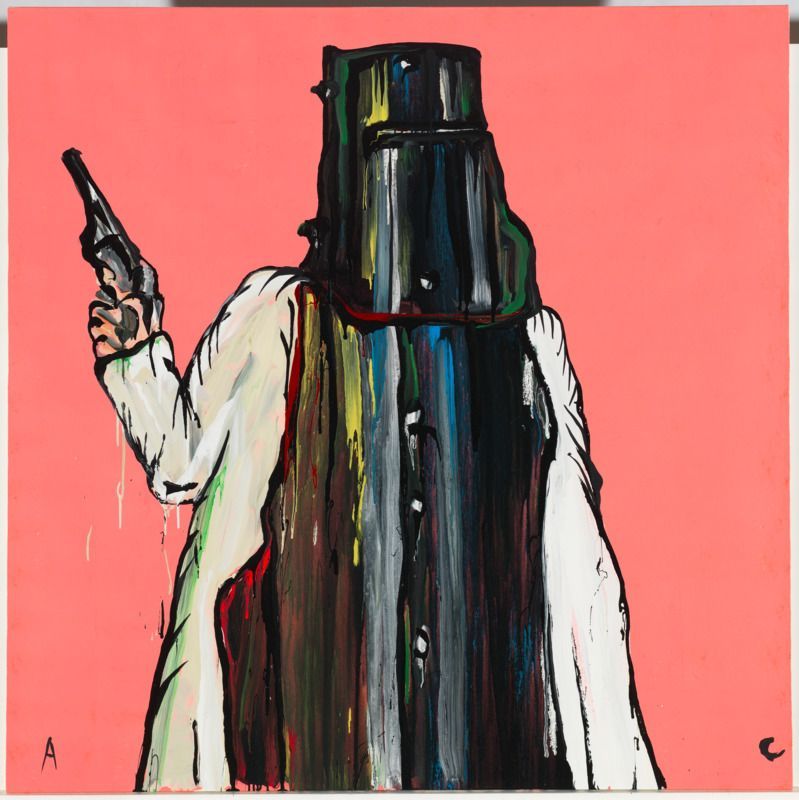

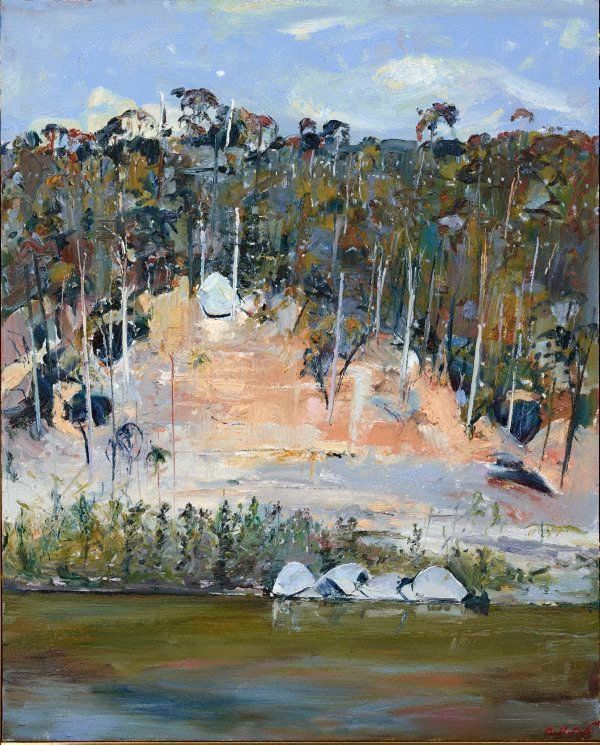

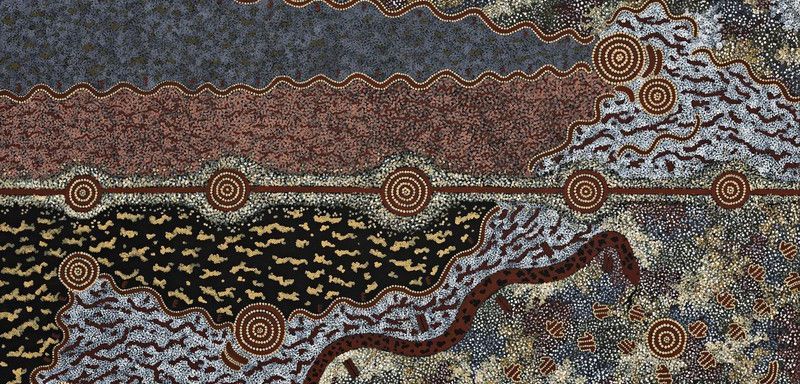

Art Index - Artists Gallery

Art Index News & Insights

LATEST NEWS

INSIGHTS

"85% of Deloitte’s Wealth Managers agree that Fine Art is an essential part of wealth management strategy. "

"Australian art sales have increased by $30 million year on year 21-22 - with almost 3 times the amount of volume passing through Australian auction houses."

"The average annual price for Australian Indigenous Art has increased by over 200% since 2019."

"There has never been a better time to invest in art, and the interest in art as a viable asset is only set to grow in 2022."